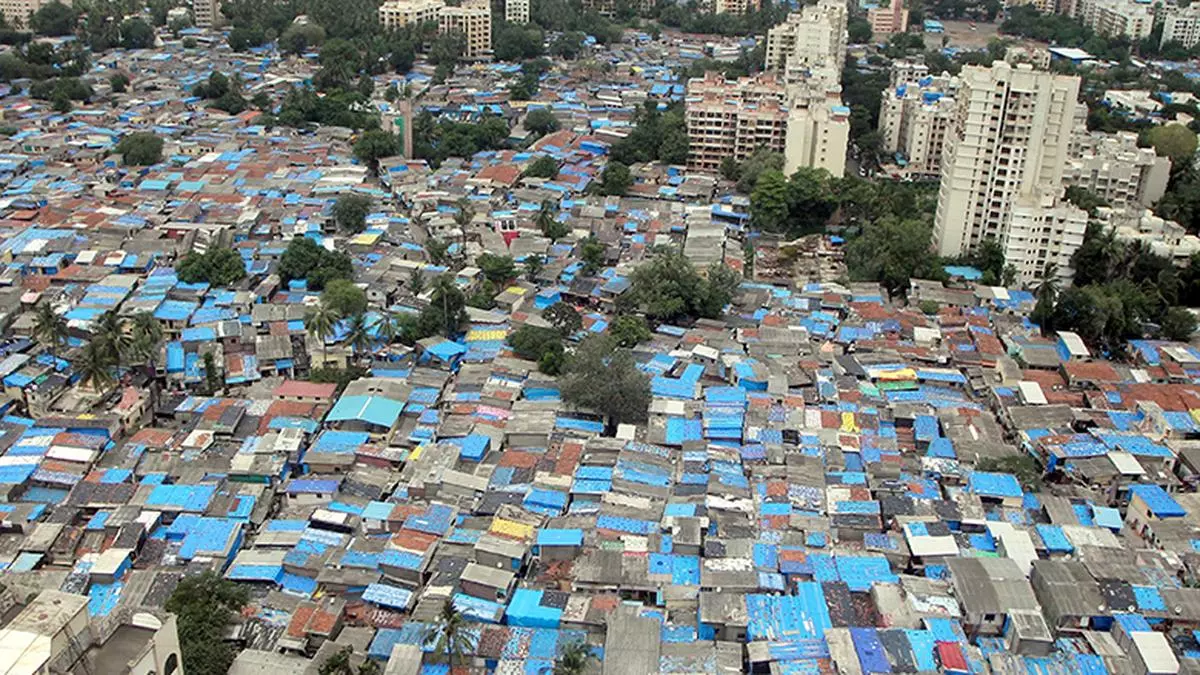

Last week, Raymond Ltd honcho Gautam Singhania pointed out that Mumbai was built 60-80 years ago, and a large part of the city was slum, adding that redevelopment projects presented a $2-trillion opportunity. This is an opportunity that developers are not letting go, as for a land-starved city, redevelopment is the only way for builders to get their hands on prime real estate in the financial capital, the biggest real estate market in the country.

According to market circles data from the Maharashtra Housing and Area Development Authority show there are over 25,000 housing societies in the city that will be up for redevelopment.

For a developer, the attraction in redevelopment project is the free additional floor space index (FSI) that they get and which can be sold to more customers. The FSI for redevelopment projects can go as high as 2.5 in some areas.

Despite the litigations, the difficulties in getting everyone to agree and challenges that redevelopment projects face, the pace has intensified with large, deep pocketed, premium players getting into the act.

“There is no open land left in south Mumbai, so redevelopment is definitely the only option for developers to get access to prime land in the city,” said Divyesh Doshi, Director at Kinjal group, which has undertaken and delivered around 10 redevelopment projects in the city and has a project ongoing.

Last week, premium developer Oberoi Realty announced a redevelopment agreement for a 12,790 square meter land parcel in Worli, that would generate a free sale component of 6 lakh sq ft for the builder. In January, Kolte Patil Developers received two redevelopment projects in Mumbai with a saleable area of over 3 lakh sq ft and a revenue potential of ₹545 crore. Mahindra Lifespace Developers has a redevelopment project in Malad that will be launched this year. Rustomjee Group has made redevelopment a strong focus area and has undertaken a number of projects in the city. Singhani said he was bidding for projects worth ₹5,000 crore in south Mumbai.

The biggest and most ambitious redevelopment project in the city is that of Dharavi slum cluster, which is being undertaken by the Adani group, at a total cost of $3 billion.

Micromarkets

The most prominent micromarkets in Mumbai that are slated for redevelopment includes Worli, Lower Parel, and Bandra-Mahim, said Vedanshu Kedia, Director, Prescon Group. “Given their proximity to major business districts, these micromarkets presents a unique opportunity for transformation.”

The Maharashtra government had implemented policies that favoured redevelopment such as increased FSI, cluster redevelopment that was pushing the redevelopment market, Doshi said.

Another driving factor for redevelopment is the fact that such projects get upgraded amenities, more open spaces with all safety installations in place. This is especially true of the older buildings in south Mumbai built in an era when there was less stress on conveniences or safety standards.

Challenges

The pace of redevelopment is however not as fast as many would like to see chiefly because selecting the developer, arriving at an agreement with all the stakeholders, approving the project takes a lot of time.

“Some of the major challenges in redevelopment projects include obtaining the consent of residents, logistical complexities of relocating large populations, and ensuring adequate compensation and housing for the displaced,” said Kedia.

Legal and regulatory delays further complicate the timelines and feasibility of these projects, he added.

Rent that the developer has to pay on behalf of residents during the redevelopment period attracts GST and this adds to the cost, reducing the viability of the project, pointed out Jayesh Rathod, director, Guardian Real Estate Advisory.

“It has an impact on the bottomline, it makes the developer think whether they should do it or not,” he said, adding that there should be some relaxation on this.

In the island city, several housing societies were located on narrow congested roads and adhering to the mandated open spaces pose a challenge to developers. “The FSI for the redeveloper is not enough to accommodate the amenities as well as open spaces, it would not be commercially viable for developers,” he explained. Some relaxation in this respect would also give a boost to the projects.

In the final analysis however, “Redevelopment is the future as far as potential of real estate in Mumbai is concerned,” Rathod said.

+ There are no comments

Add yours